A New Rival for Boeing and Airbus Planes? The Chinese Comac C919

China is famous for building companies that can challenge the dominance of the west: Baidu, WeChat, Alibaba and Huawei vs. Google, Facebook, Amazon and Ericsson. There are many other examples.

But China is a developing country and still has many key technologies to cover. One of them is in civil aviation, where the dominance of Airbus and Boeing is so far undisputed. In this article we will see if the new Comac C919 accomplishes a breakthrough in this area.

What is Comac?

Comac is a state-owned Chinese aerospace company founded in 2008. When founded, it absorbed a consortium of Chinese aviation companies that had already built a small regional plane, the ARJ21.

As of today, about 70 ARJ21 have been sold, mainly to Chinese airlines. Chengdu Airlines has the largest share with 25 planes, but the rest of their fleet is made of 39 Airbus A320. Internationally, there is only one in service for a small Indonesian airline called TransNusa.

Comparing with the 900 CRJ700 planes sold by Bombardier (a similar regional model as the ARJ21), we can safely say that the ARJ21 has not been a success, neither in China nor internationally. Despite this, it has served as a stepping stone over which the new Comac C919 hopes to continue developing.

Specs of the Comac C919

Comac wants to compete directly with the top-selling Airbus A320neo and Boeing B737 MAX 8, so they are trying to make a making a very similar plane.

The sizes are almost identical in terms of weight, height, length and wingspan. But there is an important difference: while the A320neo has a range of 6,300 km, the C919 can only reach 4,500 km. This difference is mainly due to the size of the fuel tank. Comac will release an Extender Range (ER) model of the C919 which will be able to reach 5,500 km, but this is still far from the A320neo default. It's not clear why Comac designed their plane with such short range, since this can have a big influence in the airlines decision.

To compensate for the short range, Comac planned a very attractive feature: a low price. The initial estimate was $50 million USD per plane, but over the course of the project this tag has almost doubled. Since no planes have been sold yet, the price estimates can still change, but in a recent statement from China Eastern Arilines they noted that they plan to buy 5 C919 planes at ¥653 million each ($98 million).

The price range is therefore lower than the A320neo ($110 million) and the B373 MAX 8 ($121 million), but remains at a similar order of magnitude. Still, this difference might make it more attractive for airlines from other developing countries.

Not entirely Chinese made, for now

Rather than “made” in China, I would say that the plane is “assembled” in China, since most systems have been manufactured in the West.

We can see that the airframe is the only section which is all Chinese made. This section is also challenging to produce. Much so, that the original plan to make the wings of carbon fiber composites was later replaced by aluminum alloys to reduce design complications. For comparison, 50% of the Airbus A350’s airframe is made of carbon-fiber composites.

But China is playing a long-term race here. If they want a competitive plane, they need the expertise of the West to make their first breakthrough. The gained expertise can then serve as a base for the development of their own engines, landing gear, controls, etc. Unfortunately, there have been reports of industrial espionage during this process.

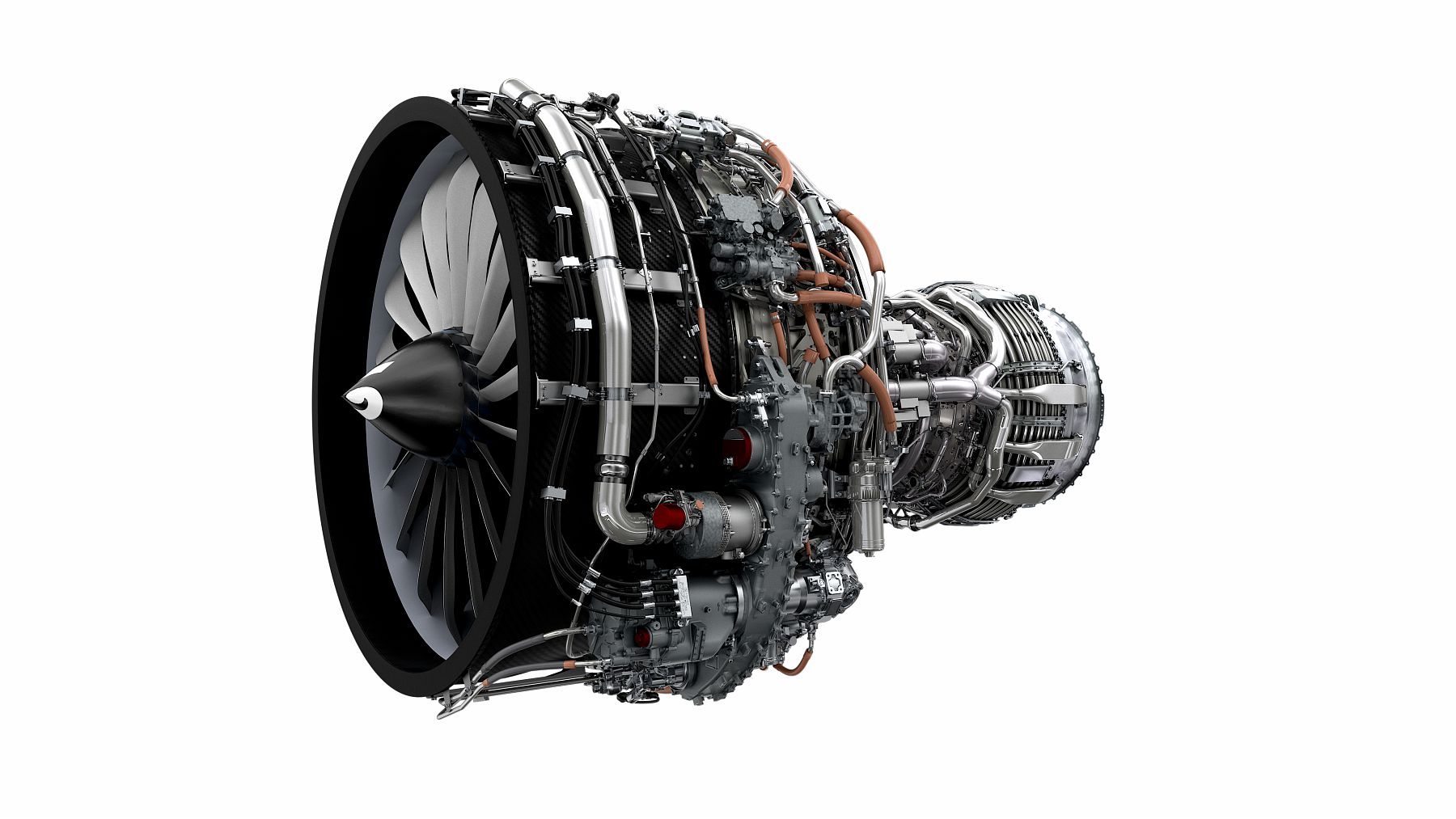

The key element of a plane, it's engine, will be the most difficult section to develop. Working at maximum temperatures of 1,700 °C and producing over 100kN of force, building one requires a very slow process of design and testing until high efficiency and durability is achieved.

Delays in the C919 manufacturing

The timeline of the C919 project seems very long: 14 years, and counting

But the truth is that all planes take long time to be build and licensed. For comparison, the Airbus A320neo took about 10 years from the launch of the “Enhanced” project till the first delivery. The Boeing 737 MAX took 8 years.

The longer timeline of Comac is attributed to two factors: technical problems and supply chain issues. The first one is probably due to the lack of experience for these types of planes. The second one is due to delays in the delivery of critical components from the beginning of the project. These delays were mainly caused by trade restrictions, some raised from an economic point of view, others due to ties of Comac with other military companies.

In 2020, some members of the US government proposed to block General Electric from selling the engines to China. However, president Donald Trump allowed the sale stating that “We’re not going to be sacrificing our companies...by using a fake term of national security. It’s got to be real national security”.

Trump knew that if the engines were not sold by the US, China will go ahead and make their own. But China was already working on that. The ACAE CJ-1000A engine is the Chinese made backup for the Comac C919, but its still under development and might not be as efficient and the western models.

Certification

China does not want to replicate the failure of the Russian Sukhoi Superjet 100. This plane was introduced in 2008 and also aimed at competing with Airbus and Boeing. However, its hope for success was quickly shattered after two fatal crashes, many technical failures and a very poor support for spare parts. In 2017, a report from Russian media outlet Vedomosti stated that 20% of the Sukhoi's fleet had been grounded due to technical issues in their tail stabilizers.

The two fatal crashes from the Boeing B737 MAX 8 are another example of low quality deliveries. Other crashes from Boeing not directly attributed to technical problems have undermined even more Boeing's image of safety. Comac should be aware that quality is an important parameter here.

Comac is very close to complete the certification for its own regulator, the Civil Aviation Administration of China (CAAC). This was achieved after a total of 4,200 hours flight hours where each system was carefully monitored. Such certification will allow it to fly within Chinese borders and serve the massive internal traffic that they already have.

To expand abroad, they will need to comply with the regulations from the Federal Aviation Administration (FAA) in the US, the European Union Aviation Safety Agency (EASA) and others. But second certifications go faster since they can validate most of the work done for one in the country of origin.

Producing 10 planes a month

A successful certification will not ensure success for the C919. Comac has already received 170 firm orders, and 300 more within memorandums or understanding. Keeping up with demand is a very challenging process, the investment is big, and not supplying the products means bankruptcy. Tesla almost went down in 2018 when they ramped up the production of the S3 model.

After certification, Comac will start low-rate production by building a few planes a year, each needing an individual signature from the regulators. This might be a calm period. After this, high-rate production begins, usually with 10 planes a month. Airbus has the current record on this with its A320: 60 built in one month (now they have raised the goal to 75).

As we saw before, most systems of the Comac C919 are imported, so they will need a superb management of their supply chain to ensure that all the parts are delivered required time and quantity. The instabilities caused by the Russian invasion of Ukraine is only making this harder for China.

Conclusion

There has probably never been a worse timing to release a new plane: pandemic times (China is still in heavy lock down) and a war in Ukraine which has disrupted the global supply chain. China plays with the advantage that Boeing is going through a low period due to their failure with the B737 MAX 8, but Airbus is riding the wave with its successful A320neo.

Will China surprise the world again?